Dream11’s valuation nears $5 billion on $400 million fund-raise

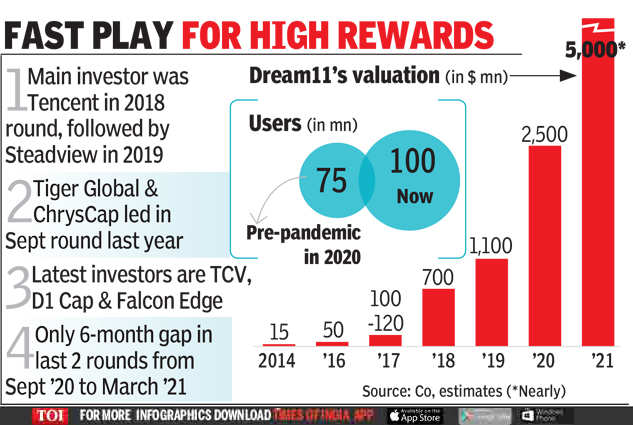

BENGALURU: Dream Sports, which owns online fantasy sports platform Dream11, has closed a $400 million funding round led by marquee global technology investors like TCV, which was an early investor in Netflix, D1 Capital Partners and Falcon Edge. Post this funding, Dream11’s valuation has shot up to nearly $5 billion, almost doubling in six months, according to people briefed on the matter.

This is a completely secondary fund-raise where some of Dream11’s early investors like Multiples Alternate Asset Management and Kalaari Capital have sold parts of their stake with multi-bagger returns but Chinese technology major Tencent hasn’t sold any of its single-digit holding in what’s now one of the top-tier startups in India.

In September 2020, Dream11 had conducted a largely secondary funding of $225 million at a valuation of $2.5 billion. In a secondary transaction, new investors buy shares from existing investors and the money does not go into company coffers.

Besides new investors like TCV, for which this will be its first India investment, Dream11’s existing investors like Tiger Global, ChrysCapital, TPG Growth, Steadview Capital and Footpath Ventures have also participated in this round. Falcon Edge Capital, co-founded by Navroz Udwadia, has invested in Dream 11 through Alpha Wave, which invests in growth-stage startups.

Dream11 has hit another milestone of having 100 million users, a first for a fantasy gaming firm in India, company founder and CEO Harsh Jain told TOI. According to him this is the single largest investment in the Indian online gaming ecosystem and a testimony to its growth potential.

“The fact that we are doing only secondaries right now signals two things. One is that we have enough growth capital internally, like good companies should, at this mature stage. Then, we are excited to give our early-stage investors very handsome returns. This will further improve the VC ecosystem in India,” Jain told TOI. This, he said, will enable limited partners, who invest in VC funds, to invest more in new VC funds. Jain, however, ruled out any plans to launch an initial public offering (IPO) any time soon unlike some of other Indian startups aiming to public in 2021 or 2022.

Avendus Capital was the exclusive financial advisor to Dream Sports on the transaction.

The mega-funding round comes right before popular cricketing event IPL which is expected to boost its revenue as more users engage in fantasy gaming with live sporting events like IPL happening next month.

“We were hit during the March-June period last year. July onwards, we started coming back to normalcy but even now quite a few tournaments have been canceled. So, we are still 80% (of pre-Covid-19 levels) but fantasy sports now has scaled up to a point where we have real revenue and we have just crossed 100 million users,” Jain added. The company had around 75 million users before the pandemic. Dream 11, which was title sponsor of IPL last year, has also turned profitable, Jain said. He declined to share further details on the same.

Dream 11’s fund-raise comes amid regulatory uncertainty around the sector where some states see it as a ‘game of skills’ while others are planning tighter regulation as people spend real money on these platforms. Government think-tank Niti Aayog has proposed a national level guidelines for the sector along with suggestions of setting up a self-regulatory body.

“Any disruption, you’ll have increased scrutiny. For fantasy sports, having been proven by the Supreme Court of India multiple times over as a game of skill and not gambling (money), that’s one of the main pillars (for fantasy sports),” Jain said.

“India is home to the world’s largest and most energetic sports fan base with a dynamic mix that is unique to the subcontinent. Dream Sports is serving this community with a highly innovative product offering,” Gopi Vaddi, general partner, TCV, said in a statement.